Xylem Inc. (NYSE: XYL), a leading global water technology company dedicated to solving the world’s most challenging water issues, today reported second quarter 2021 revenue of $1.35 billion. Revenues grew 16 percent on a reported basis, and 11 percent organically, reflecting strong underlying demand across all segments.

Second quarter adjusted earnings before interest, tax, depreciation and amortization (EBITDA) margin grew 200 basis points to 17.3 percent. The margin expansion was driven by productivity, mix and volume leverage from strong underlying demand. Xylem generated net income of $113 million, or $0.62 per share, and adjusted net income of $119 million, or $0.66 per share, which excludes the impact of restructuring, realignment and special charges.

“Our team capitalized on robust global demand for our offerings, driving revenues above expectations, and fuelling exceptional growth in new orders and backlog,” said Patrick Decker, Xylem’s president and CEO. “That commercial momentum puts us in a strong position for the second half and beyond, as we continue to invest in sustainable growth. We expect the team to build on continuing market recovery, giving us confidence in lifting full-year guidance.”

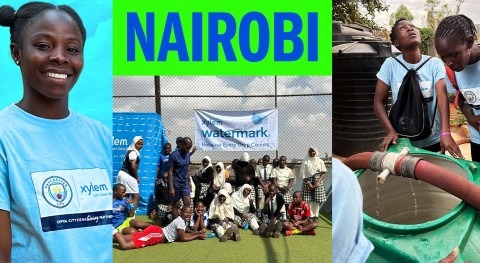

“During the quarter we also reported progress toward our 2025 sustainability goals – including moving major facilities onto renewable energy, and helping customers recycle more than a trillion gallons of water,” continued Decker. “The report demonstrates the strong link between our business and sustainability strategies. We partner with customers to provide more resilient infrastructure, drive affordability, and create a more sustainable water sector. That’s our purpose and our business. As climate change drives water challenges in communities around the world, we intend to be part of the solution.” (Download Xylem’s 2020 sustainability report.)

Revenues grew 16 percent on a reported basis, and 11 percent organically, reflecting strong underlying demand across all segments.

Updated Outlook

Xylem now expects full-year organic revenue growth to be in the range of 6 to 8 percent, and 9 to 11 percent on a reported basis. This represents an increase from the Company’s previous full-year organic revenue guidance of 5 to 7 percent, and 8 to 10 percent on a reported basis. Full-year adjusted earnings per share is now expected to be in the range of $2.55 to $2.70. The increased guidance reflects commercial momentum from the first half, as well as continuing demand and price realization in the second half, partially offset by incremental inflation and supply chain challenges.

Second Quarter Segment Results

Water Infrastructure

Xylem’s Water Infrastructure segment consists of its portfolio of businesses serving wastewater transport and treatment, clean water delivery, and dewatering.

- Second quarter 2021 revenue was $569 million, up 14 percent on a reported basis, and up 6 percent organically, compared with the same period in 2020. Modest growth in utilities was driven by opex demand in Western Europe and the U.S. Industrial end markets were up double- digits driven largely by Emerging Markets mining demand.

- Second quarter adjusted EBITDA margin was 19 percent, flat versus the prior year period. Reported operating income for the segment was $93 million and adjusted operating income, which excludes $4 million of restructuring and realignment costs, was $97 million. The segment reported operating margin was 16.3 percent, up 170 basis points versus the prior year period. Adjusted operating margin rose 80 basis points to 17 percent. Strong productivity savings and volume offset inflation and investments.

Applied Water

Xylem’s Applied Water segment consists of its portfolio of businesses in industrial, commercial building, and residential applications.

- Second quarter 2021 revenue was $414 million, up 23 percent on a reported basis, and up 18 percent organically, compared with the same period in 2020. Growth was driven by strong demand across industrial, residential and commercial end markets driven by broad recovery from COVID challenges in the prior year.

- Second quarter adjusted EBITDA margin was 17.4 percent, up 200 basis points from the prior year period. Reported operating income for the segment was $64 million and adjusted operating income, which excludes $2 million of restructuring and realignment costs, was $66 million. The segment reported operating margin was 15.5 percent, up 330 basis points versus the prior year period. Adjusted operating margin rose 250 basis points to 15.9 percent. Strong volume leverage and productivity more than offset inflation.

Measurement & Control Solutions

Xylem’s Measurement & Control Solutions segment consists of its portfolio of businesses in smart metering, network technologies, advanced infrastructure analytics and analytic instrumentation.

- Second quarter 2021 revenue was $368 million, up 14 percent on a reported basis, and up 11 percent organically, compared with the same period in 2020. Growth was driven by volume in water applications from large metrology contract deployments, and by strong demand in water quality testing applications globally.

- Second quarter adjusted EBITDA margin was 13.9 percent, up 460 basis points from the prior year period. Reported operating income for the segment was $13 million and adjusted operating income, with no restructuring and realignment costs in the quarter, was $13 million. The segment reported operating margin was 3.5 percent, up 1780 basis points versus the prior year period. Adjusted operating margin rose 510 basis points to 3.5 percent. Strong productivity savings, favorable mix, and volume leverage more than offset inflation and investments.

Supplemental information on Xylem’s second quarter 2021 earnings and reconciliations for certain non- GAAP items are posted at www.xylem.com/investors.